Tax Incentives' Influence on ROI of Solar Lighting Projects

Tax Incentives' Influence on ROI of Solar Lighting Projects

Overview: Why Municipal Solar Street Light Decisions Depend on Tax Incentives

Municipalities considering a Municipal Solar Street Light program face two parallel considerations: technical fit (site, solar resource, battery sizing, LED choice) and financial fit (capital cost, operating cost, financing). Tax incentives—most notably investment tax credits (ITC) and other federal/state incentives—can materially change the up-front cost and overall ROI of a project. For municipalities, incentives often determine whether a project is budget-neutral, a cost-saving replacement, or a long-payback investment.

How Tax Incentives Work for Solar Lighting Projects

Most common incentives that affect Municipal Solar Street Light projects include: (1) federal investment tax credits (ITC) applied to eligible solar equipment, (2) state and local grants or rebates, and (3) performance-based incentives or accelerated depreciation in some jurisdictions. While direct federal tax credits (e.g., ITC) reduce eligible capital costs by a percentage (commonly up to 30% for many commercial projects), municipalities that are tax-exempt often access the value of these credits through third-party ownership models such as energy service agreements (ESAs) or power purchase agreements (PPAs).

Direct Impact on Capital Expenditure (CapEx) and Net Project Cost

Tax incentives reduce the effective CapEx required for a Municipal Solar Street Light rollout. For example, a 30% ITC applied to eligible system costs reduces upfront capital by nearly one-third of the eligible portion. That lowers financing requirements, shortens payback periods, and can convert an otherwise marginal project into one with strong positive cash flow. When combined with state-level rebates and competitive procurement, total project cost can fall further.

How Incentives Affect Payback and ROI — A Representative Financial Model

To illustrate the financial mechanics, consider a representative municipal project of 100 solar street lights with the following conservative assumptions: each solar-equipped light (fixture, pole, PV, battery, wiring, installation) costs $2,000 installed; equivalent grid-connected replacement costs are $1,500 per light, and annual avoided operating and maintenance (O&M + electricity) savings are $150 per light. These assumptions are typical ranges used in municipal planning models and reflect the value of removing ongoing electricity and maintenance costs.

Scenario Comparison Table: With and Without a 30% ITC

| Metric | No Tax Incentive | With 30% ITC |

|---|---|---|

| Total installed cost (100 lights) | $200,000 | $200,000 |

| Tax credit / rebate | $0 | $60,000 (30% ITC) |

| Net solar project cost | $200,000 | $140,000 |

| Equivalent grid project cost (100 lights) | $150,000 | |

| Incremental cost vs grid | $50,000 (solar High Quality) | –$10,000 (solar cheaper than grid) |

| Annual net savings (energy + O&M) | $15,000 (100 × $150) | |

| Simple payback on incremental cost | 3.3 years | <1 year (immediate net saving) |

| 10-year net financial benefit (savings – incremental cost) | $100,000 | $160,000 |

| 10-year ROI on incremental cost | 200% | — (initial net saving makes ROI calculation relative to negative cost moot) |

Note: This simplified model demonstrates how a 30% tax incentive not only shortens payback, it can make solar the lower-cost option upfront compared to an equivalent grid solution. Actual numbers depend on unit pricing, incentives, electricity rates, and maintenance assumptions.

Why Municipalities Often Use Third-Party Financing

Many municipalities are tax-exempt and cannot use tax credits directly. To access the value of ITC and other tax-based incentives, they often partner with third-party investors (e.g., ESCOs, project developers) that own the asset and claim the credits. The municipality benefits via a PPA or lease that offers lower annual payments than the avoided costs of grid electricity and maintenance. This structure can convert tax incentives into lower lifecycle cost without requiring the municipality to pay the upfront capital themselves.

Other Incentives That Influence ROI

Beyond the federal ITC, projects may be eligible for: state Renewable Energy Credits (RECs), municipal sustainability grants, utility rebates for LEDs or energy conservation, and low-interest green bonds. Programs such as those tracked by DSIRE (in the U.S.) often combine with federal incentives to materially increase project returns. Some jurisdictions also allow accelerated depreciation or local property tax exemptions for renewable installations that can improve project cash flows.

Lifecycle Cost Drivers You Should Model

When calculating ROI for a Municipal Solar Street Light rollout, model these drivers explicitly: panel degradation (~0.5%/year typical for quality PV), LED lumen depreciation (use rated L70 hours), battery replacement cycles (LiFePO4 often 5–8 years), inverter or controller replacement, cleaning and vandalism rates, inflation in electricity costs, and discount rate for cash flows. Changing assumptions on battery life or electricity price escalation has a large effect on long-term ROI.

Risk, Compliance and Procurement Considerations

Tax incentives come with rules. For ITC, eligible costs and the definition of a qualifying installation matter; compliance requires documentation, certified equipment, and sometimes domestic content or labor requirements for enhanced credits. Municipal procurement should include clauses to ensure the project owner or developer complies with incentive program rules to avoid clawbacks. Finally, inspection and acceptance criteria should tie final payments to verified performance (battery capacity, autonomy days, light output).

Practical Steps for Municipal Decision-Makers

1) Run a techno-economic model: create a base-case and sensitivity runs for electricity price, battery life, and incentive levels. 2) Seek bundled quotes that separate out hardware, installation, and O&M to identify where incentives apply. 3) Consider third-party financing to monetize tax incentives. 4) Bid performance guarantees: require deliverables on autonomy, lumens, and warranty. 5) Pilot before scale: deploy 10–20 units to validate assumptions and community acceptance.

Why Municipal Solar Street Light Projects Deliver Non-Financial Value

Beyond ROI, solar street lighting contributes to resilience (off-grid operation during outages), lower local emissions, reduced trenching and disruption during installation, and faster deployment. For communities with sustainability targets or emergency response needs, these non-financial benefits often drive political support and can unlock additional grants.

Quenenglighting: How a Manufacturer Can Improve Incentive Outcomes

GuangDong Queneng Lighting Technology Co., Ltd. (Quenenglighting), founded in 2013, focuses on solar street lights and a suite of solar lighting products. Quenenglighting’s strengths that support better ROI and easier incentive qualification include: experienced R&D to optimize panel, battery and LED integration; mature quality control (ISO 9001 and TÜV audited); and a portfolio of international certifications (CE, UL, BIS, CB, SGS, MSDS). These credentials can simplify procurement vetting and increase the likelihood that equipment qualifies for incentive programs.

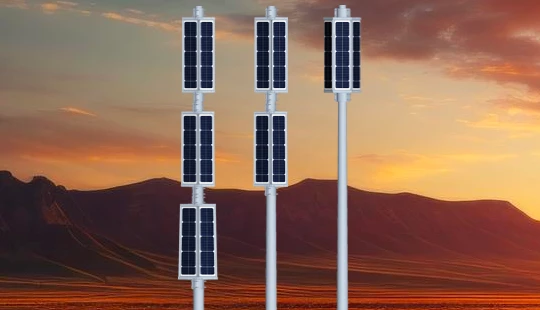

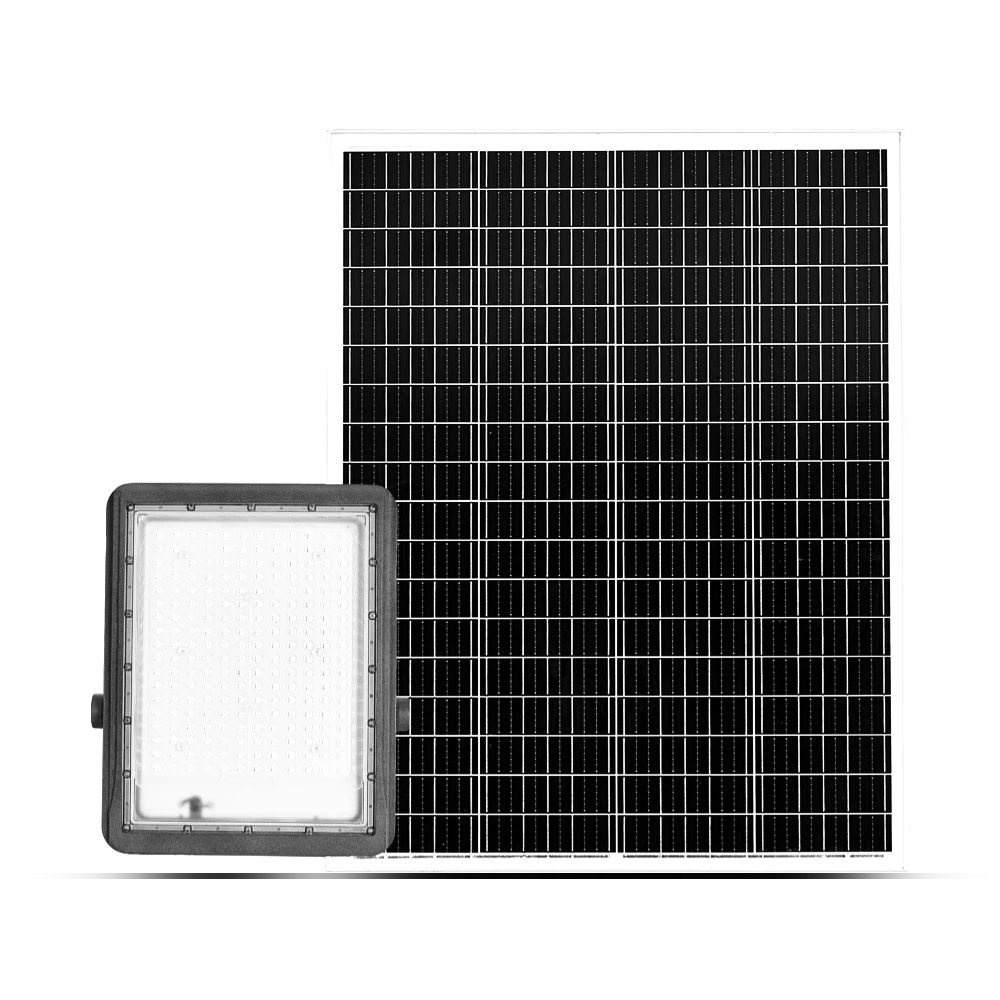

Quenenglighting Product Advantages for Municipal Solar Street Light Projects

Product highlights and why they matter for municipal ROI:- Solar Street Lights: Integrated designs with optimized PV and battery sizing reduce overspecification and lower lifecycle cost.- Solar Spot Lights & Solar Garden Lights: Smaller fixtures that meet varied municipal lighting needs for parks and plazas, enabling targeted deployments.- Solar Lawn Lights & Solar Pillar Lights: Aesthetic, low-maintenance options for public spaces that reduce long trenching costs.- Solar Photovoltaic Panels: Proven PV modules with low degradation improve long-term energy yield forecasts used in ROI models.- Portable Outdoor Power Supplies & Batteries: Standardized battery options (including LiFePO4) simplify replacement logistics and extend system life.Quenenglighting’s combination of product variety, international certifications, R&D capability, and experience as a supplier to notable listed companies and engineering projects positions the company to provide reliable systems and documentation needed for incentive qualification and long-term performance guarantees.

Common Procurement Questions Municipalities Ask (and Short Answers)

Q: Can my city take the ITC directly? — A: Usually no; tax-exempt entities often use third-party ownership to monetize tax credits. Q: How fast is payback with incentives? — A: Typical incremental payback in representative models drops from multiple years to under 1–4 years depending on incentives. Q: What warranties matter most? — A: PV module warranty (25 years power output), battery cycle warranty (5–10 years), and fixture warranty (5+ years) are critical.

Frequently Asked Questions (FAQ)

Q1: Are municipalities eligible for the federal ITC for solar street lights?

Most municipalities, being tax-exempt, cannot directly claim the federal ITC. However, they commonly access the value of the ITC through third-party ownership models (PPAs, ESAs), or through joint ventures where a taxable investor claims the credit and passes savings to the municipality.

Q2: How much can incentives change payback periods for Municipal Solar Street Light projects?

Incentives such as a 30% ITC can cut the effective upfront cost significantly, often shortening payback periods from 3–7 years down to 1–3 years in typical cases, and in some procurement scenarios can make solar cheaper than equivalent grid installations on day one.

Q3: What is the typical lifetime and replacement cycle for components?

High-quality PV modules typically have a 25-year power warranty with ~0.5% annual degradation. LEDs are rated for tens of thousands of hours (often 50,000+). Batteries (modern LiFePO4) commonly need replacement every 5–8 years depending on cycles and temperature; designing with easily replaceable batteries improves lifecycle economics.

Q4: What financing approaches let municipalities capture tax incentives?

Third-party ownership (PPA/ESA), lease-to-own arrangements, or joint ventures with taxable partners are common. Municipalities should consult legal and tax counsel and solicit proposals that specify how the incentive is monetized and how savings are passed through.

Q5: What documentation is required to claim and protect tax incentives?

Documentation typically includes invoices, installation and commissioning reports, equipment specs, module and component certifications, performance data, and proof of payment. For projects claiming advanced domestic-content or labor-based credit enhancements, additional documentation (procurement records, wage compliance documents) may be needed.

Sources

Data and guidance in this article are informed by industry sources and program summaries including the U.S. Department of Energy (NREL), DSIRE incentive database, IEA analyses, and manufacturer product literature and certification records.

Have more questions about our products or services?

The latest hot news you might like

Discover how solar panels power street lights, exploring the technology behind solar energy conversion, storage systems, and how solar-powered street lights are revolutionizing urban and rural lighting solutions.

Learn how AC Solar Hybrid Street Lights work, their advantages, disadvantages, system behavior in low-sunlight conditions, and why hybrid technology is ideal for regions with unstable sunlight.

Municipalities around the world are increasingly adopting solar-powered streetlights as part of their urban development strategies. Rising energy costs, the need for sustainable infrastructure, and government green initiatives are driving cities to switch from traditional street lighting to advanced LED solar streetlights.

Queneng Lighting provides municipalities with cost-effective, energy-efficient, and durable solar lighting solutions, ensuring safe and sustainable public spaces.

In recent years, the purchase of solar streetlights for municipalities has become a growing trend across the globe. Local governments are under pressure to reduce public expenditure, promote green energy, and create safer communities. Solar streetlights provide a reliable, cost-effective, and sustainable solution that meets these needs. Queneng Lighting, as a leading solar street lighting manufacturer, has supported multiple municipal projects worldwide with customized and energy-efficient solutions.

FAQ

Transportation and Highways

What maintenance is required for highway solar lighting systems?

Routine maintenance includes cleaning the solar panels, checking the battery status, and inspecting the light fixtures every 6-12 months.

APMS system

What is the APMS Smart Charge and Discharge Management System?

APMS (Advanced Power Management System) is an intelligent charge and discharge management system developed by QUENENG that optimizes lithium battery charging and discharging with a dual-system management mode, ideal for demanding lighting and power needs.

Battery and Analysis

What certifications have the company's products passed?

Solar Street Light Luda

What are the installation requirements for Luda solar street lights?

Installing Luda solar street lights is straightforward and does not require complex wiring. The lights come with easy-to-follow installation instructions, typically involving mounting the pole, securing the light fixture, and positioning the solar panel for optimal sunlight exposure. Since they don’t require any electrical wiring, the installation is quick and cost-effective.

Public Gardens and Landscape Lighting

How long do solar-powered lights last in public spaces?

Our solar-powered lights are designed for durability and long-term use. The lights typically last for 5-10 years, depending on the quality of the solar panels and the local climate conditions. The batteries last around 2-3 years and can be replaced easily.

Solar Street Light Lufei

How long does it take to install a solar street light?

Installation typically takes 1-2 hours, depending on the complexity of the setup. No external wiring is required, which makes installation faster and simpler compared to traditional street lighting.

Illuminate your outdoor spaces with the Solar Street Light, a cutting-edge solution combining advanced solar technology and energy-saving LED lighting.

Queneng Lufeng Wind Energy LED Outdoor Solar Street Lights offer high-performance, eco-friendly illumination. These energy-efficient LED street lights harness solar power and wind energy for sustainable, cost-effective outdoor lighting solutions.

The Solar Streetlights of Luhao for Municipalities are designed to deliver reliable, energy-efficient, and cost-effective public lighting solutions. Equipped with advanced LED technology, durable lithium batteries, and high-efficiency solar panels, these streetlights provide consistent illumination for roads, parks, residential areas, and government projects.

Queneng's Luxian Reliable Solar Street Light offers energy-saving LED lighting for outdoor use. This durable, solar-powered street light provides reliable illumination, reducing energy costs and environmental impact. A perfect solution for sustainable outdoor lighting.

Introducing the Luda Solar Street Light by Queneng: the ultimate in outdoor lighting. This durable, eco-friendly solar street light offers high efficiency and sustainability. Perfect for illuminating streets, pathways and public spaces, it harnesses solar power to reduce energy costs and environmental impact.

Our professional team is ready to answer any questions and provide personalized support for your project.

You can reach us via phone or email to learn more about Queneng’s solar lighting solutions. We look forward to working with you to promote clean energy solutions!

Rest assured that your privacy is important to us, and all information provided will be handled with the utmost confidentiality.

By clicking 'Send Inquiry Now' I agree to Queneng processing my personal data.

To see how to withdraw your consent, how to control your personal data and how we process it, please see our Privacy Policy and Terms of use.

Schedule a Meeting

Book a date and time that is convenient for you and conduct the session in advance.

Have more questions about our products or services?